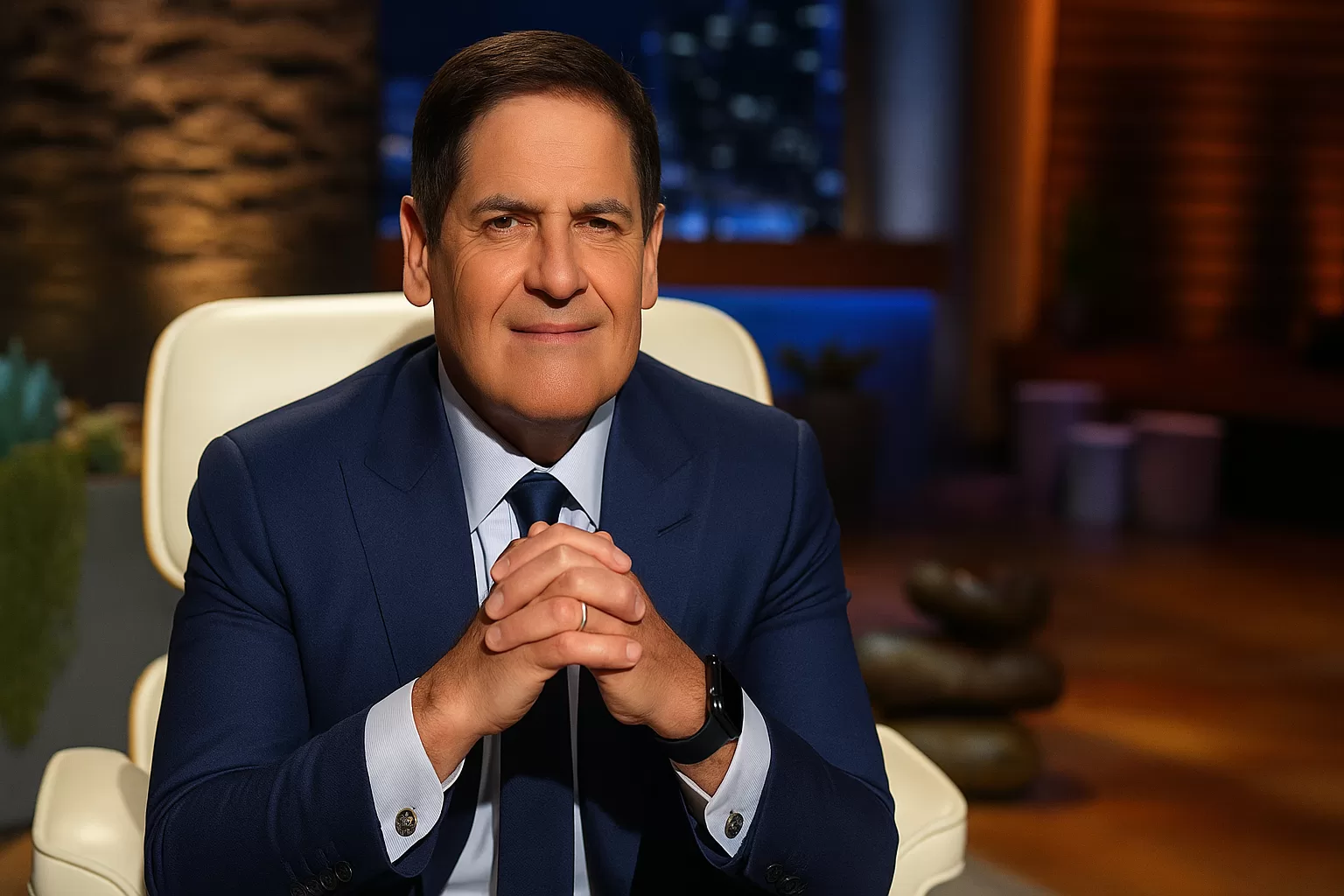

Title: Mark Cuban and Harbinger Sports Partners: Redefining Ownership in American Sports Economics

📰 PRIMAL MOGUL EXECUTIVE FEATURE: MARK CUBAN

By Elijah Moorson

Contributing Analyst | Primal Mogul Power Reports

Strategic Expansion: Mark Cuban New Era in Sports Capital

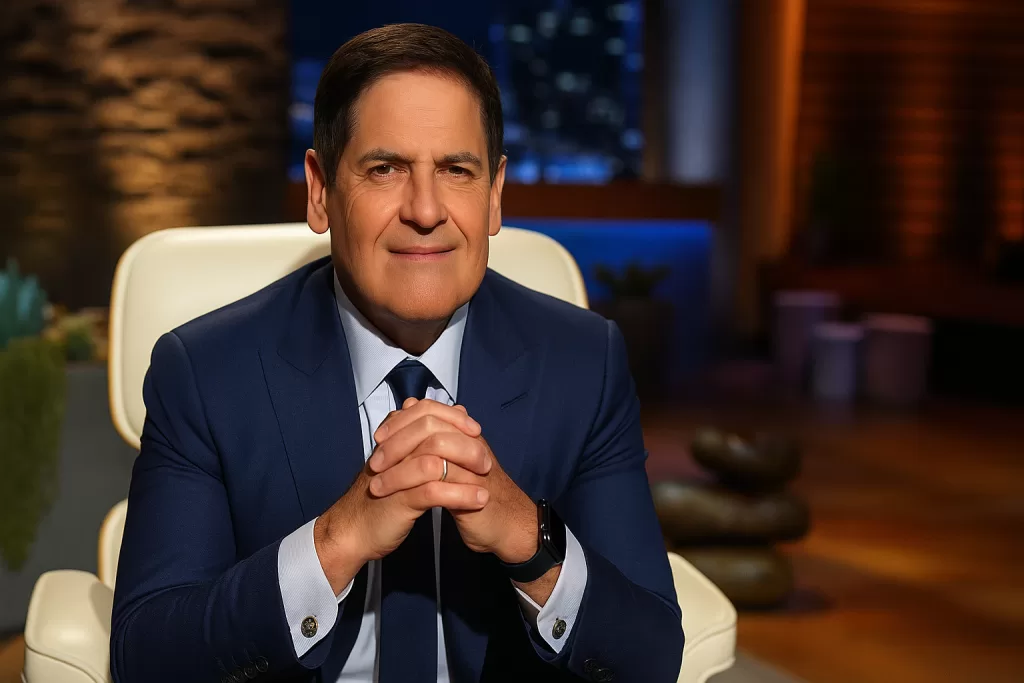

Mark Cuban, former Dallas Mavericks majority owner and serial entrepreneur, has quietly initiated a significant transformation in U.S. professional sports ownership.

In partnership with a high-caliber executive team. Cuban has launched Harbinger Sports Partners. A $750 million private equity fund with a singular focus—acquiring minority ownership stakes in NFL, NBA, and MLB franchises.

This initiative is designed with a disciplined financial strategy: capital allocations ranging from $50 to $150 million per transaction, targeting equity positions up to 5% in each organization.

Rather than anchoring the fund to a single marquee acquisition, Harbinger is structured to assemble a multi-club portfolio of passive but influential ownership positions across major leagues.

The Core Leadership Structure

The fund is led by a team of seasoned professionals with operational and cultural fluency across sports, finance, and brand development:

- Mark Cuban, General Partner – Former NBA team owner, tech innovator, and enterprise investor.

- Steve Cannon, CEO – Former CEO of Mercedes-Benz USA and current NFL team executive with deep infrastructure experience.

- Rashaun Williams, Chief Investment Officer – Noted venture capitalist with expertise in scaling cultural capital and identifying undervalued IP in lifestyle-driven sectors.

Together, this team represents a highly specialized formation: economic strategy, corporate operations, and culture-forward investing. Operating under a common structure of controlled acquisition and targeted influence.

Capital as Leverage: Why Minority Stakes Hold Long-Term Value

Harbinger’s structure is intentionally precise. A minority equity stake, though numerically limited, often includes:

- Board-level access to governance decisions

- Voting rights in league operations and expansion discussions

- Visibility into financial disclosures and monetization strategy

- Access to media, naming, and regional broadcast negotiations

In the current economic climate, as franchises reach record valuations and the business of sports expands into streaming, sports betting, digital content, and international licensing. Even partial ownership represents long-term capital leverage.

Cuban’s method prioritizes influence through diversified presence. Each 3–5% stake functions as an embedded asset in a high-growth cultural and financial vehicle.

This approach eliminates operational burden while still inserting decision-making capacity.

The Broader Economic Environment

Private equity has increasingly moved into sports. From Arctos Sports Partners to Dyal HomeCourt, multi-club investment models have shifted league dynamics.

The NFL recently approved the inclusion of private equity ownership, creating a new landscape of institutional capital blending with legacy family ownership.

Harbinger enters this environment with an adaptive edge. The firm’s strategy reflects an awareness of how modern sports function not only as athletic showcases but also as scalable media ecosystems, civic assets, and marketing platforms.

The cultural currency of teams—especially those in metropolitan regions—extends across fashion, politics, philanthropy, and global youth engagement.

Harbinger’s targeting model suggests a valuation methodology that accounts not only for financial yield but for the impact of narrative equity and lifestyle capital.

The Cultural Implication of Strategic Ownership

For emerging moguls and high-net-worth cultural investors, Cuban’s move provides a tested framework. The Harbinger model demonstrates how:

- Capital groups can enter elite ownership tables without requiring full control

- Asset diversification across leagues provides protection from league-specific volatility

- Long-hold investments in sports franchises function as both financial and geopolitical positioning tools

Mark Cuban has not framed this fund as a philanthropic exercise or a celebrity investment.

It is a precision capital vehicle, structured for long-term wealth compounding, governance visibility, and silent command within a cultural cornerstone of the American economy.

Primal Mogul Takeaway

The sports industry remains one of the most protected, politicized, and profitable sectors in the United States. Franchises are multigenerational assets.

They function as financial fortresses, often doubling in valuation within a single decade. For culturally fluent investors, the path forward is clear.

Leverage collective capital, focus on passive ownership strategies, and enter the sports arena through structured syndication.

Mark Cuban has provided a contemporary template for executing this strategy with scale and credibility.

His partnership with Cannon and Williams solidifies Harbinger as a fund engineered for leadership at the intersection of commerce, culture, and capital strategy.

Tactical Advisory:

→ Study Harbinger’s formation, governance, and target criteria.

→ Apply this model to regional sports teams, esports organizations, or emerging media properties.

→ Begin assembling or joining capital syndicates structured around long-term passive equity in high-growth cultural assets.

Primal Mogul is not here just to observe the era of wealth. We are here to engineer it.

This is your reference blueprint for scalable, intelligent ownership in the most guarded asset class in America.